SHADOW BANKING

ASSET-BACKED COMMERCIAL PAPER

The Basics

Asset-Backed Commercial Paper (ABCP) is a financial instrument used mainly by businesses to obtain funding. Investors in ABCP essentially act as borrowers when they buy its securities.

The securities are “secured”, meaning that their creator offers up assets that are held as collateral until the maturity date of the paper. In the event of a borrower default, these assets are distributed amongst the investors.

One of the qualities of ABCP that makes it so appealing to investors is that it is typically “credit enhanced”. This can be done many ways, but two are used most frequently.

The maturity of ACBP can reach a maximum of 270 days, after which the principal must be repaid. The purpose of this is to avoid having to register the securities with the Securities and Exchange Commission (SEC), thus reducing the cost of reporting and compliance.

Investing in ABCP is a relatively low risk, low return venture. Given the short maturity, its secured status, and its credit enhancement, these securities rarely default. Also, consider that a company would have to be in pretty good standing in order to convince a sponsor to guarantee their ABCP.

The securities are “secured”, meaning that their creator offers up assets that are held as collateral until the maturity date of the paper. In the event of a borrower default, these assets are distributed amongst the investors.

One of the qualities of ABCP that makes it so appealing to investors is that it is typically “credit enhanced”. This can be done many ways, but two are used most frequently.

- Overcollateralization: The value of the underlying assets equal more than the total value of the paper. This protects investors from both the credit risk of the paper as well as the underlying assets.

- Sponsorship: A bank or bank-like entity (sponsor) will guarantee the stream of payments made to the investors. This essentially moves the credit risk of the borrower to the credit risk of the sponsor, and generally improves the chances that the investors will get their payments.

The maturity of ACBP can reach a maximum of 270 days, after which the principal must be repaid. The purpose of this is to avoid having to register the securities with the Securities and Exchange Commission (SEC), thus reducing the cost of reporting and compliance.

Investing in ABCP is a relatively low risk, low return venture. Given the short maturity, its secured status, and its credit enhancement, these securities rarely default. Also, consider that a company would have to be in pretty good standing in order to convince a sponsor to guarantee their ABCP.

Mechanics of ABCP

Imagine that you are in charge of raising funds for your company. You have been tasked to quickly raise $5 billion, but there isn’t a bank that is willing and able to provide you with such a line of credit within the necessary timeframe. You decide that instead you will raise the funds by launching an ABCP program.

The first step will be to set up a special purpose vehicle (SPV) that will issue the paper and hold the underlying assets collateral. The SPV, acting as an independent entity, then buys the collateral from the company wishing to borrow. The SPV then issues securitized paper similar in structure to that of a bond, which in some form or fashion is dependent on the amount of collateral being held.

Investors wishing to pursue a low risk, low return investment product purchases this paper. The paper can be traded or held during its lifespan, but on the maturity date the borrower company buys back the underlying assets at a previously agreed upon price that is higher than that which they sold them. This money is used to pay back the investors who hold the paper on the maturity date. After the process is complete, the SPV is shut down.

In the end, the borrower has benefitted from a quick and easy means of obtaining large amounts of credit at a low cost, and the investors enjoy a return on their investment in the ABCP program.

The first step will be to set up a special purpose vehicle (SPV) that will issue the paper and hold the underlying assets collateral. The SPV, acting as an independent entity, then buys the collateral from the company wishing to borrow. The SPV then issues securitized paper similar in structure to that of a bond, which in some form or fashion is dependent on the amount of collateral being held.

Investors wishing to pursue a low risk, low return investment product purchases this paper. The paper can be traded or held during its lifespan, but on the maturity date the borrower company buys back the underlying assets at a previously agreed upon price that is higher than that which they sold them. This money is used to pay back the investors who hold the paper on the maturity date. After the process is complete, the SPV is shut down.

In the end, the borrower has benefitted from a quick and easy means of obtaining large amounts of credit at a low cost, and the investors enjoy a return on their investment in the ABCP program.

This video shows the flows of money in a ABCP program. On the issue date, the collateral (orange box) is moved from the borrower to the lender. Then the lender invests money in the SPV, who immediately sends it to the borrower. On the maturity date, the money is returned (with interest) to the SPV, who immediately sends the collateral back to the borrower and the money to the lender.

ABCP and the Great Recession

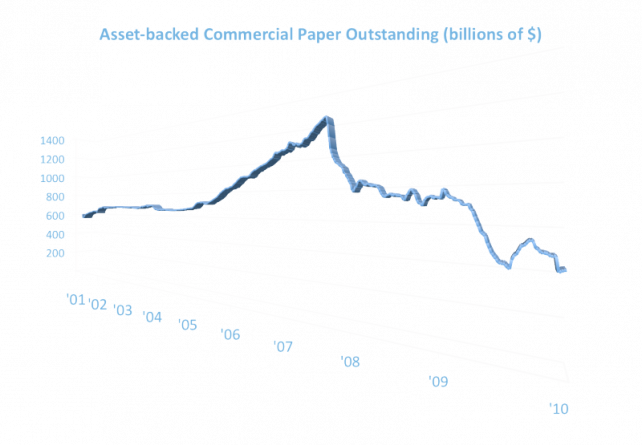

ABCP saw a rise in popularity in the mid 2000’s because borrowing rates were very low and companies were finding it cheaper to borrow using ABCP. The success of these programs brought short-term optimism to the market and the short-term nature of the securities furthered this optimism.

Soon, more conservative investors, such as money market mutual funds (MMMFs) and retirement funds began partaking in the purchase of ABCP. This optimism and the new players brought an increased demand for ABCP, and borrowers met this demand by rolling over the debts from mature paper into new paper.

August of 2007 brought a different story. The market quickly snapped back when the housing bubble caused borrowing rates to increase to a point where rollovers became too pricy. This forced a good number of companies to stop borrowing via ABCP.

The next big fall in the ABCP took place in September 2008. While it was known that banks were failing, which would have increased risk in the ABCP market due to a lack of sponsors, the primary cause if the ABCP crash has yet to be fully determined. A popular story is that a MMMF run took place, which left borrowers with no one which to sell their paper. The lack of demand caused rates to skyrocket and very quickly rollovers became impossible. Many borrowers were forced to exit the market.

Soon, more conservative investors, such as money market mutual funds (MMMFs) and retirement funds began partaking in the purchase of ABCP. This optimism and the new players brought an increased demand for ABCP, and borrowers met this demand by rolling over the debts from mature paper into new paper.

August of 2007 brought a different story. The market quickly snapped back when the housing bubble caused borrowing rates to increase to a point where rollovers became too pricy. This forced a good number of companies to stop borrowing via ABCP.

The next big fall in the ABCP took place in September 2008. While it was known that banks were failing, which would have increased risk in the ABCP market due to a lack of sponsors, the primary cause if the ABCP crash has yet to be fully determined. A popular story is that a MMMF run took place, which left borrowers with no one which to sell their paper. The lack of demand caused rates to skyrocket and very quickly rollovers became impossible. Many borrowers were forced to exit the market.

Why is ABCP so popular?

THE BORROWER

For the borrower, ABCP is great for a wide variety of reasons. First, it’s a faster and, given its market-based nature, can be a cheaper way to raise funds. Since the maturity for the paper can be no longer than 270 days, all it takes for a company to obtain cheap credit is to have a solid short-term outlook.

Second, the borrower can more easily manage some risks associated with borrowing. The SPV is by nature “bankruptcy remote,” meaning that since it is a separate entity, if the borrower has to default then it is the SPV, not the borrower, that declares bankruptcy. Thus, all that would be lost by the borrower are the underlying assets held as collateral.

A caterpillar, like the one pictured below, can be seen as an ideal metaphor for demonstrating how a company can increase their financial stability by using SPV’s.

As mentioned earlier, an SPV is bankruptcy remote, which protects the parent company from having to go into bankruptcy in the event of a default to an ABCP program. If the company uses multiple funding programs involving SPV’s, then they can maximize their total line of credit while remaining relatively safe from bankruptcy.

A caterpillar, by having many legs, employs a similar strategy. In the event that one of its legs becomes useless or falls off, the caterpillar still has no trouble standing upright and going about its normal business.

Similarly, if a company with multiple SPV-related programs defaults on one of the programs, the default doesn’t affect the livelihood of the company as a whole. The company might become slightly impaired for a while, but the consequences are much less than if there were no SPV programs put in place.

THE INVESTOR

The borrower also enjoys some cool benefits from ABCP programs. First, as mentioned earlier, the securitized paper is secured by assets and credit enhanced by either overcollateralization or sponsorship (or both).

These qualities of ABCP protect the investor from multiple kinds of risk. First, secured paper protects the investor from borrower default risk. The fact that the paper is securitized mitigates liquidity risk (however, it doesn’t erase it entirely; remember ABCP is big stuff so only a certain number of players can play this game).

Also, the credit enhancements protect the investor from the risk of a devalued underlying asset. Many ABCP programs require that the assets be valued using mark-to-market accounting, and if the value of the assets decrease the SPV requires more collateral from the borrower. A sponsor offers the same protection by guaranteeing that the investor will earn the intended return. However, one must be wary that a sponsor doesn’t eliminate the risk, rather they take it on themselves. If the sponsor were to default, then that risk falls back on the borrower and the underlying assets.

A caterpillar, by having many legs, employs a similar strategy. In the event that one of its legs becomes useless or falls off, the caterpillar still has no trouble standing upright and going about its normal business.

Similarly, if a company with multiple SPV-related programs defaults on one of the programs, the default doesn’t affect the livelihood of the company as a whole. The company might become slightly impaired for a while, but the consequences are much less than if there were no SPV programs put in place.

THE INVESTOR

The borrower also enjoys some cool benefits from ABCP programs. First, as mentioned earlier, the securitized paper is secured by assets and credit enhanced by either overcollateralization or sponsorship (or both).

These qualities of ABCP protect the investor from multiple kinds of risk. First, secured paper protects the investor from borrower default risk. The fact that the paper is securitized mitigates liquidity risk (however, it doesn’t erase it entirely; remember ABCP is big stuff so only a certain number of players can play this game).

Also, the credit enhancements protect the investor from the risk of a devalued underlying asset. Many ABCP programs require that the assets be valued using mark-to-market accounting, and if the value of the assets decrease the SPV requires more collateral from the borrower. A sponsor offers the same protection by guaranteeing that the investor will earn the intended return. However, one must be wary that a sponsor doesn’t eliminate the risk, rather they take it on themselves. If the sponsor were to default, then that risk falls back on the borrower and the underlying assets.

Dangers of ABCP

Despite these safeguards and the high ratings ascribed to ABCP, the programs are still susceptible to what is called a "shadow bank run" (see Bank Run). There are a number of things that can cause a run, all of which can happen in a matter of days, or even hours.

One way an ABCP program can experience a run is by investors believing that the borrowing company can't pay them back. Initially, this doesn't have to be a consensus among all the investors. It may begin with one major investor who holds this belief; they will either try to sell their paper or they will refuse to roll it over. Either way, more paper will be available for sale. This increase in the quantity supplied, while only a small and ambiguous piece of information, could tip off the other investors to the fact that the borrower may be insolvent. Determined not to avoid losing everything investors will start selling like crazy, driving the price way down. The next time the borrower goes to roll over their debt, they find that investors are only willing to give them market price, which is drastically less than face value, and certainly not enough to pay back old debt.

The herd mentality of the investors stems from shadowy nature of these ABCP programs. Investors generally have very little idea of what is done with the money they invest. We see the same mentality in a retail bank run, where those who hold checking accounts know very little about what their bank does with their deposits. The only information depositors at a retail bank have to gauge the solvency of their bank is whether or not there's a line out the door, but when that information is present its investors are quick to mitigate their losses. The only way for both shadow and traditional banking systems to mitigate this issue is by allowing themselves to become more transparent.

One way an ABCP program can experience a run is by investors believing that the borrowing company can't pay them back. Initially, this doesn't have to be a consensus among all the investors. It may begin with one major investor who holds this belief; they will either try to sell their paper or they will refuse to roll it over. Either way, more paper will be available for sale. This increase in the quantity supplied, while only a small and ambiguous piece of information, could tip off the other investors to the fact that the borrower may be insolvent. Determined not to avoid losing everything investors will start selling like crazy, driving the price way down. The next time the borrower goes to roll over their debt, they find that investors are only willing to give them market price, which is drastically less than face value, and certainly not enough to pay back old debt.

The herd mentality of the investors stems from shadowy nature of these ABCP programs. Investors generally have very little idea of what is done with the money they invest. We see the same mentality in a retail bank run, where those who hold checking accounts know very little about what their bank does with their deposits. The only information depositors at a retail bank have to gauge the solvency of their bank is whether or not there's a line out the door, but when that information is present its investors are quick to mitigate their losses. The only way for both shadow and traditional banking systems to mitigate this issue is by allowing themselves to become more transparent.

Citations

Maturity Date - The date when the face value of the security must be repaid by the issuer

Credit Risk - The likelihood that the issuer of the security will default

Special Purpose Vehicle - A company set up to hold collateral and issue securities, such as ABCP

Securitized - When an issuer divides the amount they wish to be the total face value of their debt issuance into evenly valued notes, a.k.a. securities

Chart data gathered from research.stlouisfed.org

Rolling Over - The act of paying off old debt by issuing new debt.

Liquidity Risk - A measure of how how easy (or hard) it is to turn a security into cash.