SHADOW BANKING

REPURCHASING AGREEMENTS

The Basics

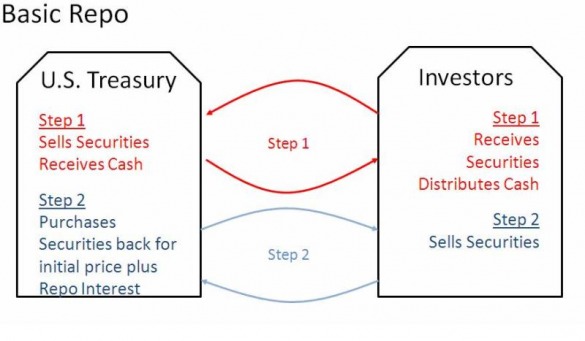

A Repurchasing Agreement, or "Repo", is a financial agreement between two market participants in which collateral is offered in exchange for cash in order to satisfy issues of liquidity, usually short-term.

Typically these transactions were between two financial entities who either were in demand for a way to store excess funds in a safe secure system, or needed short-term funds to finance programs. The two players were

Historically, the foundations of the Repo market are synonymous with the U.S. Treasury Department and the securities they issue. These bonds are understood when purchased on a certain date, that upon culmination of the maturity of the bond the U.S. Treasury will repurchase the bond for the original amount plus interest on the investment.

This historical perspective on the Repurchasing Agreement market is built on the reputation of the U.S. Treasury and guarantee placed on the bonds they issue. In lament terms, there is zero worry that the U.S. Treasury will default on the bond.

Typically these transactions were between two financial entities who either were in demand for a way to store excess funds in a safe secure system, or needed short-term funds to finance programs. The two players were

- Borrower: Financial entity that served as a "bank" to acquire funds. Would issue bonds to the lenders in return for their deposits

- Lender: Financial entity that served as the "lender" conceding their funds to the borrower in order to have a safe place to store excess funds.

Historically, the foundations of the Repo market are synonymous with the U.S. Treasury Department and the securities they issue. These bonds are understood when purchased on a certain date, that upon culmination of the maturity of the bond the U.S. Treasury will repurchase the bond for the original amount plus interest on the investment.

This historical perspective on the Repurchasing Agreement market is built on the reputation of the U.S. Treasury and guarantee placed on the bonds they issue. In lament terms, there is zero worry that the U.S. Treasury will default on the bond.

Growth of Repurchasing Agreement Markets

The Borrower

Over the past 25 years, the nature of the Repo market has evolved away from just the safe and secure dealings of the U.S. Treasury and started accepting a broad range of securities as collateral. From credit card debt to mortgages, banks bought up debts, packaged and sold them to Special Purpose Vehicles in exchange for securities.

While the banks were holding these SPV issued securites until they could be sold, the opprotunity materialized for the banks to offer a service to satisfy the ever increasing needs of other financial firms short-term saving plans.

In the current Repo market, the banks desired to become more leveraged, so they were focused on short-term liquidity needs and the Repo market satisfied that need. In return for their SPV securites, which were just sitting on the balance sheet of the banks, they were able to match up with a single buyer and gain their liquidity needs.

Haircuts

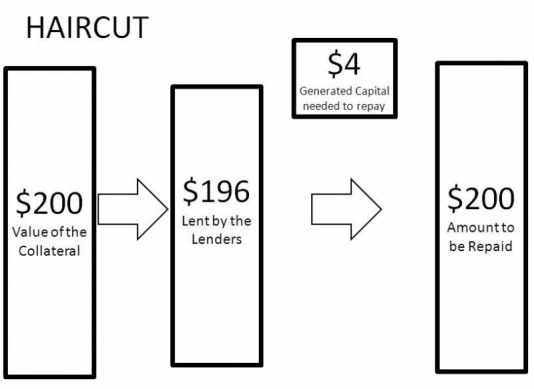

Necessary to the Repo market, just as in the private loan system, the existence of a discernible amount lended against the market value of the collateral pledged. This difference between the market value and the collateral pledged is called a haircut.

A basic example would be pledged market value collateral of $200 with a haircut of 2%. The lender would then offer $196 against the collateral so as to protect their interests. With the haircut in place, the borrowers were responsible for wrangling up $4 worth of equity within their books to cover the cost of the transaction when the Repurchase Agreement culminated. This meant that the banks were taking their short-term boost in funds to do quick, typically day trades to secure their equity to repay their Repos.

Over the past 25 years, the nature of the Repo market has evolved away from just the safe and secure dealings of the U.S. Treasury and started accepting a broad range of securities as collateral. From credit card debt to mortgages, banks bought up debts, packaged and sold them to Special Purpose Vehicles in exchange for securities.

While the banks were holding these SPV issued securites until they could be sold, the opprotunity materialized for the banks to offer a service to satisfy the ever increasing needs of other financial firms short-term saving plans.

In the current Repo market, the banks desired to become more leveraged, so they were focused on short-term liquidity needs and the Repo market satisfied that need. In return for their SPV securites, which were just sitting on the balance sheet of the banks, they were able to match up with a single buyer and gain their liquidity needs.

Haircuts

Necessary to the Repo market, just as in the private loan system, the existence of a discernible amount lended against the market value of the collateral pledged. This difference between the market value and the collateral pledged is called a haircut.

A basic example would be pledged market value collateral of $200 with a haircut of 2%. The lender would then offer $196 against the collateral so as to protect their interests. With the haircut in place, the borrowers were responsible for wrangling up $4 worth of equity within their books to cover the cost of the transaction when the Repurchase Agreement culminated. This meant that the banks were taking their short-term boost in funds to do quick, typically day trades to secure their equity to repay their Repos.

The Lender

Evolving with the banking system, the fincancial sector was not immune to innovation. With the rise of securitization and the Repo market, so did the number of players interested in collaborating within the confines of the Repo market. Pension Funds, Hedge Funds, and Insurance Companies were all taking their peice of the unregulated pie so to speak as they were constantly engaging in these overnight, quick return transactions.

These lenders were cash heavy with a lack of secure places to house such large quantities of their clients' funds. So as the Repo market was established, so the did number of lenders. In return for their funds, the firms would receive collateral in the form of securites. Securites that had been washed clean through the SPV mechanism making them senior is quality and safety.

Rehypotecation

With the returns of their funds coming overnight, there were also postive externatlities for the lenders as well. It was a crucial agreement in the Repo market transactions that firms who acted as the lenders had the explicit right to engage in the Repo market with the securites they receive. This equated into bonds issued from the SPV could have been rehypothecated several times with the duration of one day. Making several transactions and sources for money reliant upon one single securitized debt.

Why Repurchase Agreements Markets are considered Shadow Banking and The Great Recession

Informational-Insensitive Debt

Debt whose value is immune to informational fluctuations. Meaning that that debt will have a consistent rating and value.

Demand Deposits

As the Repo market expanded to accept various types of securities as collateral coupled with the transactions understood to be operating on an overnight basis, the lenders could voluntaryily remove their funds from the market at anytime. Therefore establishing the loans made on the Repo market as demand deposit.

With the collateral utilized on the Repo market satifying both the informational-insensitive and demand deposit requirements, the Repo market serves as a banking system predicated on the fact that at anytime the lenders could withdraw their funds.

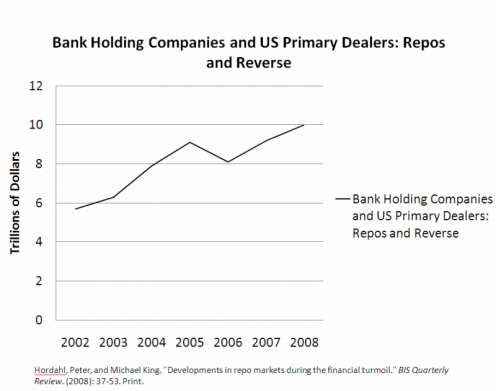

With the Repo market collateral having its foundations in mortgage back securities, as the bubble burst, so did the Repo market. The enormity of the Repo market is rumored to be as large as 10 Trillion dollars, but can not be confirmed as no regulatory agency controls the market.

Debt whose value is immune to informational fluctuations. Meaning that that debt will have a consistent rating and value.

Demand Deposits

As the Repo market expanded to accept various types of securities as collateral coupled with the transactions understood to be operating on an overnight basis, the lenders could voluntaryily remove their funds from the market at anytime. Therefore establishing the loans made on the Repo market as demand deposit.

With the collateral utilized on the Repo market satifying both the informational-insensitive and demand deposit requirements, the Repo market serves as a banking system predicated on the fact that at anytime the lenders could withdraw their funds.

With the Repo market collateral having its foundations in mortgage back securities, as the bubble burst, so did the Repo market. The enormity of the Repo market is rumored to be as large as 10 Trillion dollars, but can not be confirmed as no regulatory agency controls the market.

Citation

Gorton, Gary, and Andrew Metrick. "Securitized Banking and the Run on Repo." Yale International Center for Finance. (2009): Print.

Gorton, Gary. "Slapped in the Face by the Invisible Hand: Banking and the Panic of 2007+." Yale and NBER. (2009): Print.

Gorton, Gary, and Andrew Metrick. "The Run on Repo and the Panic of 2007-2008." Yale and NBER. (2009): Print.

Hordahl, Peter, and Michael King. "Developments in repo markets during the financial turmoil." BIS Quarterly Review. (2008): 37-53. Print.

Gorton, Gary. "Slapped in the Face by the Invisible Hand: Banking and the Panic of 2007+." Yale and NBER. (2009): Print.

Gorton, Gary, and Andrew Metrick. "The Run on Repo and the Panic of 2007-2008." Yale and NBER. (2009): Print.

Hordahl, Peter, and Michael King. "Developments in repo markets during the financial turmoil." BIS Quarterly Review. (2008): 37-53. Print.

U.S Treasury securities range from treasury bills to bonds with maturation rates ranging from a few days to 30 years

Special Purpose Vehicles: Shell business that issue securities. Have no governing body and are bankrupt immune

Leveraged: Encouraged debt practices to generate liquidity

Senior Grade: Investment rated securites